Options: Introduction

This is meant to be comprehensive series about options. Whether you’re a CFA student seeking to deepen your understanding or someone new to the world of options, this series is designed to provide you with the knowledge and tools you need to navigate this exciting aspect of the financial markets. Over the coming articles, we’ll cover a range of topics including trading strategies, the Greeks, volatility, and much more. Let’s start with the basics.

Please note: We will start slowly and maintain a steady pace. The topic of options can become quite complicated quickly, and each part builds on the previous ones. Please bear with me – I’ll provide clear explanations that are understandable to everyone to ensure we are all on the same page. Please make sure you have a strong grasp of each topic before moving on to the next one.

What Are Options? An ELI5 Explanation

ELI5: Imagine you have your eye on a beautiful house in a desirable neighborhood. You’re not ready to buy it yet, but you don’t want anyone else to snap it up. So, you make an agreement with the owner: for a small fee, you get the right to buy the house at a fixed price within the next six months. If the house’s value goes up during that time, you can buy it at the agreed price and potentially sell it for a profit. If the value goes down, you can choose not to buy it, losing only the small fee you paid for the right.

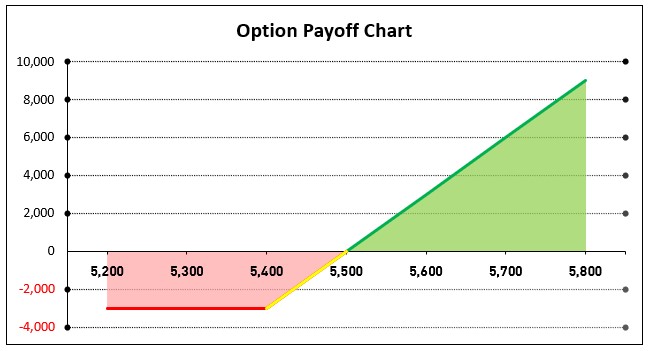

In the world of finance, an option works similarly. An option is a contract that gives you the right, but not the obligation, to buy or sell an asset (like stocks) at a predetermined price before or on a specific date. There are two main types of options:

- Call options, which allow you to buy the asset.

- Put options, which allow you to sell the asset.

Options as Contingency Claims

Options are also known as contingency claims. This means their value is contingent on the price of the underlying asset. Just like the right to buy the house is only valuable if the house’s price goes up, the value of an option depends on how the underlying asset’s price changes. If the conditions are favorable, the option can be exercised for a profit. If not, the option may expire worthless. This contingent nature is what makes options both a powerful tool and a complex financial instrument.

Why Should You Care About Options Trading?

Understanding options trading is crucial for several reasons. For CFA students, it’s not just about passing exams but about gaining a valuable skill set that can enhance your investment strategies and risk management techniques. Options are a wonderful and very flexible tool to be used to hedge against potential losses, generate income, and even leverage positions to amplify returns.

Benefits of Options Trading

- Leverage: Options allow you to control a larger position with a relatively small amount of capital. This means you can potentially achieve higher returns with less investment.

- Flexibility: With options, you can craft a variety of strategies to profit in different market conditions, whether the market is rising, falling, or trading sideways.

- Hedging: Options can act as an insurance policy for your portfolio, helping to protect against adverse price movements in the underlying assets.

- Generating Income: Options can also be used to generate income through various strategies. For example, you can sell options to other traders and collect fees, known as premiums. This can add extra income on top of what you already earn from your investments.

Risks to Keep in Mind

While options offer many benefits, they also come with risks. It’s important to understand that options can expire worthless, meaning you could lose the entire amount invested in the options contract. Additionally, the leverage that can amplify gains can also amplify losses.

What to Expect in This Series

In the upcoming articles, we’ll dive deeper into the world of options. We’ll explore various trading strategies, explain the role of the Greeks (which measure different risk factors in options trading), and discuss how volatility impacts options prices. Each article is designed to build on the last, gradually expanding your understanding and confidence in using options.

Join the Conversation

I encourage you to engage with this series by liking the posts and sharing them with your fellow CFA candidates. Your participation helps create a vibrant learning community where we can all benefit from shared knowledge and experiences.

Stay tuned for the next article where we’ll begin our exploration of specific options trading strategies. Whether you’re just starting or looking to refine your skills, this series is your gateway to mastering options trading.