You can learn through various methods such as reading, memorizing, using flashcards, and more. However, one of the best ways to learn is by practicing and taking tests! So, let’s practice.

Here are some high-quality, up-to-date questions for the CFA Level 3 exam on yield curve movements.

Enjoy!

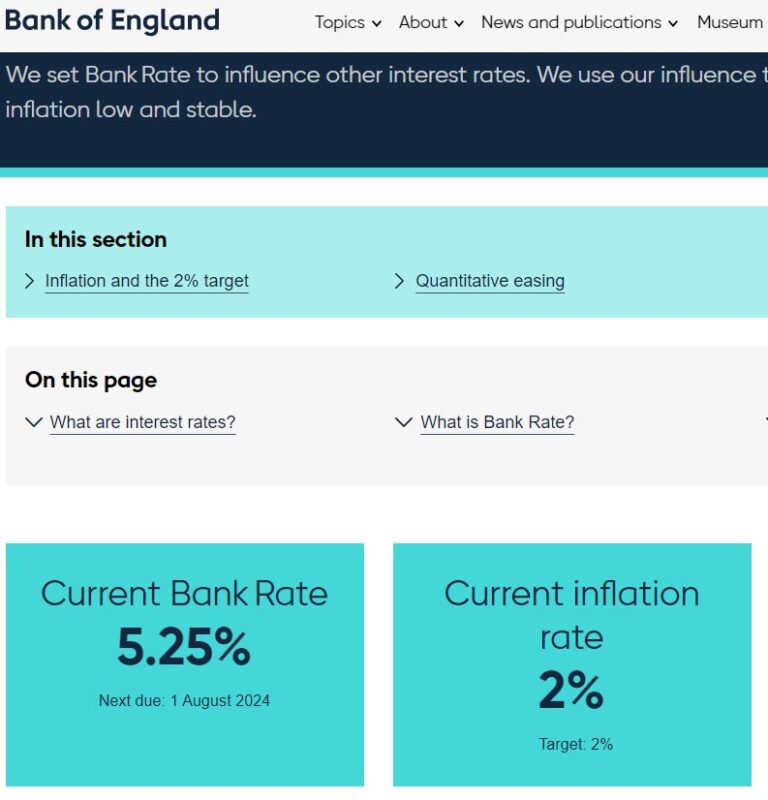

The Federal Reserve has maintained a firm stance on combating inflation, which has remained above its 2% target since 2021. As a result, the Federal Open Market Committee (FOMC) has kept the federal funds rate at a range of 5.25% to 5.5% since July 2023. This rate is the highest it has been in over two decades, reflecting a total increase of 525 basis points since early 2022. Despite some easing in the labor market and progress in reducing inflation, the Fed remains vigilant, indicating that the fight against inflation is ongoing and that further adjustments to the rates will depend on forthcoming economic data.

Current yields are:

- 1-year at 4.98%,

- 2-year at 4.6%,

- 3-year at 4.39%,

- 5-year at 4.22%,

- 10-year at 4.28%,

- 20-year at 4.57%, and

- 30-year at 4.47%.

Mike anticipates that within the next 12 months, the Fed will implement four rate cuts, each by 0.25%. We can define three points: A, B, and C. Point A represents the current moment, and Point B falls between the first and second rate cut. He expects that initially the market will remain unconvinced about the rate cut cycle and will not adjust long-term rates significantly. However, beginning before the second cut, the market will price in most of the expected cuts, resulting in a 1% decrease in long-term rates. Following this adjustment, long-term rates will stabilize with only minor changes of a few basis points thereafter. Mid-term rates will follow proportionally in response to any changes initiated at the short-term or long-term ends of the yield curve.

Paul believes that Trump will be re-elected and will pressure Powell to decrease rates by 1.5% this year. This action is expected to lead the market to anticipate higher future growth and inflation, which will be reflected in long-term rates. However, mid-term rates are likely to remain relatively stable and unaffected by these changes.

John doesn’t believe any of these revelations and is convinced that the Fed will struggle with sticky inflation much longer and will not change rates for the next 12 months. Mid-term and long-term rates on the yield curve will fluctuate slightly but won’t change significantly during this time. He has 10 years of experience employing his favorite bond strategy – rolling down the yield curve. He is convinced that in this stable yield curve environment, this strategy will work well, as it always does for him.

Kathrin thinks the rolling down the curve strategy can bring profits even in an inverted yield curve and flattening environment if the move is bullish enough.

What’s the name of the yield curve move that Mike anticipates, from point A to point B, and point B to point C?

- Answer 1: A to B it’s bear steepening, B to C it’s positive butterfly twist.

- Answer 2: A to B it’s bull steepening, B to C it’s bull flattening.

- Answer 3: A to B it’s disinversion, B to C it’s bull flattening twist.

What’s the name of yield curve movement that Paul expects?

- Answer 1: Steepening

- Answer 2: Positive butterfly twist

- Answer 3: Bull steepener

Assuming John’s expectations about a stable yield curve are correct, is he right in using the rolling down the yield curve strategy?

- Answer 1: Yes, because employing this strategy in a stable yield curve environment will deliver additional profits on top of coupon income.

- Answer 2: No, because if the yield curve is inverted and expected to be stable, rolling down the yield curve will lose money.

- Answer 3: No, because the yield curve isn’t steep enough to justify this strategy.

Is Kathrin right?

- Answer 1: Yes, for both environments (inverted curve and flattening move).

- Answer 2: No, for both environments (inverted curve and flattening move).

- Answer 3: She is half right, half wrong. The strategy will provide benefits in one environment but will lose money in the other.

Answers and explanation

What’s the name of the yield curve move that Mike anticipates, from point A to point B, and point B to point C?

- Answer 1: A to B it’s bear steepening, B to C it’s positive butterfly twist.

- Answer 2: A to B it’s bull steepening, B to C it’s bull flattening.

- Answer 3: A to B it’s disinversion, B to C it’s bull flattening twist.

Explanation:

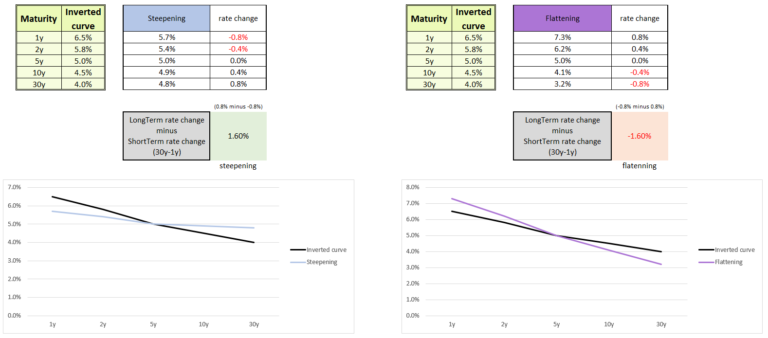

- From point A to point B: At point B, there will be change only in short-term rate as Fed will cut one time. This is make long-term rates react, but only slightly as the market will remain unconvinced about the cut cycle. It means, short-term rates will fall more then fall of long-term rates. It’s bull (rates going down) steepening (difference between LT rate change and ST rate change is positive). (Mid-term rates will follow proportionally, so it’s change in slope, not curvature.) Don’t get fooled on naming by the move on chart of inverted yield curve.

- From point B to point C: Beginning before the second cut, the market will price in 1% decrease in long-term rates. In this time, short-term rates will fall only 0.75%, meaning LT rates will fall more then ST ones. It’s bull (rates going down) flattening (difference between LT rate change and ST rate change is negative). (Mid-term rates will follow proportionally, so it’s change in slope, not curvature.) Don’t get fooled on naming by the move on chart of inverted yield curve.

What’s the name of yield curve movement that Paul expects?

- Answer 1: Steepening

- Answer 2: Positive butterfly twist

- Answer 3: Bull steepener

Explanation: According to Paul’s expectations, the Fed (pressured by Trump) will decrease short-term rates by 1.5%. The rise in inflation and growth expectations will cause long-term rates to rise, while mid-term rates will remain unchanged. This scenario represents pure steepening (a change in slope without a change in level or curvature).

Assuming John’s expectations about a stable yield curve are correct, is he right in using the rolling down the yield curve strategy?

- Answer 1: Yes, because employing this strategy in a stable yield curve environment will deliver additional profits on top of coupon income.

- Answer 2: No, because if the yield curve is inverted and expected to be stable, rolling down the yield curve will lose money.

- Answer 3: No, because the yield curve isn’t steep enough to justify this strategy.

Explanation: To make the rolling down the yield curve strategy work and be profitable, the yield when you sell the bond must be lower than when you bought it. As the name suggests – you need to roll down. In inverted curve, shorter maturities are higher. A stable yield curve is one usual requirement, but it’s not enough to make this strategy work to your advantage.

Is Kathrin right?

- Answer 1: Yes, for both environments (inverted curve and flattening move).

- Answer 2: No, for both environments (inverted curve and flattening move).

- Answer 3: She is half right, half wrong. The strategy will provide benefits in one environment but will lose money in the other.

Explanation: Inverted yield curve and flattening environment are two tough environments for rolling down the yield curve strategy to work. However, It’s not impossible.

Inverted curve: Consider an inverted curve where the 4-year rate is 0.5% higher than the 5-year rate. However, in a 1-year due to bull move on the yield curve, the yields drop by 1.5%. As a result, after one year, the rate at which you sell the bond is 1% lower than when you bought it.

Flattening move: A flattening move is generally a disadvantage for the rolling down the yield curve strategy. However, similar to the inverted curve scenario, even if the shorter maturity rate is relatively higher than the longer one, if the entire curve drops significantly by 2%, the strategy will still be profitable.